The Government of India is concerned about the people working in the unorganised sector and it has decided that if the poor working men retire they can get the security that they will not come under any financial crisis for a basic necessity. As a result, the government of India has announced a scheme named ‘Atal Pension Yojana’ listed in April 2015-16 budget. The main focus of this scheme is to uplift the people working in the Unorganised Sector. This scheme is headed by the PFRDA {Pension Fund Regulatory and Development Authority} through NPS architecture.

Some highlights of Atal Pension Yojana

- This pension scheme guarantees that its subscriber will get an amount ranging from Rs.1000 to Rs.5000 per month.

- All the bank holders may join APY.

Atal Pension Scheme Details

Check below the details of Atal Pension Yojana Scheme:

Closure

At the time of retirement, the pension will be provided to the subscriber. If in the case the subscriber is found dead due to any cause then the spouse will get the fund but in the case both the wife and husband are dead then the pension will be given to the nominee. A subscriber can only exit before 60 years in the case of extreme circumstances. Those are: in the event of death or terminal diseases.

Eligibility

If you fulfill these details listed then you are eligible for the Atal Pension Yojana-

- Should be a citizen of India

- Should have a valid Bank account

- Should be between 18 to 40 years of age

- Should contribute to the scheme for at least 20 years

- Should not be enrolled in any social welfare scheme.

Enrollment Details in Atal Pension Yojana

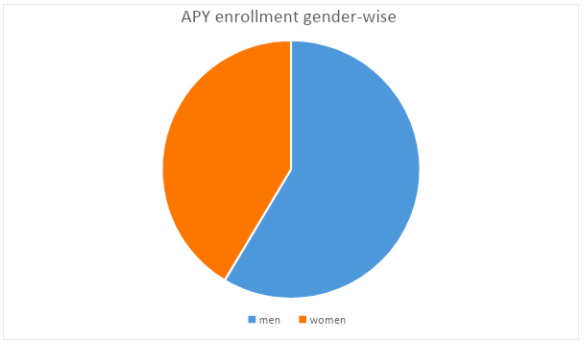

Gender wise enrollment

Out of 100%, 56.84% males and 43.14% females are enrolled in Atal pension Yojana { recorded on 31/03/2020}.

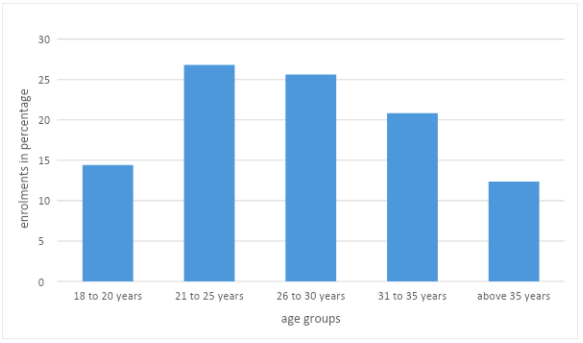

Age-wise Enrollment {recorded on 31/03/2020}

In percentage –

In numbers –

| Age Group {In years} | In Numbers Out of Total |

| 18-20 | 32,15,107 |

| 21-25 | 59,76,402 |

| 26-30 | 57,12,028 |

| 31-35 | 46,42,280 |

| above 35 | 27,55,841 |

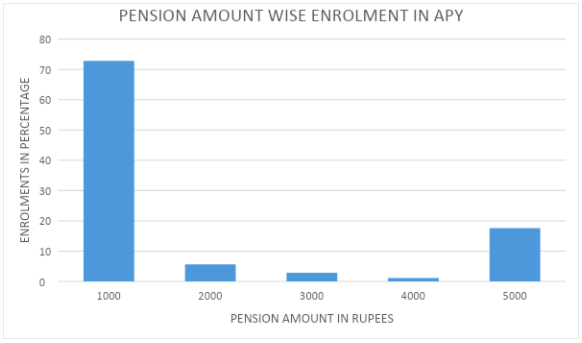

Pension Amount Wise enrollment {recorded on 31/03/2020}

In percentage –

In numbers –

| Amount in Rupees | In Numbers Out of Total |

| 1000 | 1,62,45,708 |

| 2000 | 12,50,195 |

| 3000 | 6,33,896 |

| 4000 | 2,52,879 |

| 5000 | 39,18,980 |

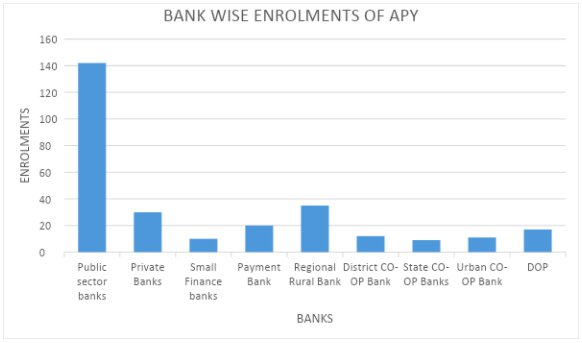

Bank Wise Enrollment {recorded on 31/03/2020}

In percentage –

In numbers –

| Banks | In Numbers Out of Total |

| public sector banks | 1,56,75,442 |

| private banks | 15,62,997 |

| small finance banks | 15,760 |

| payment bank | 3,44,001 |

| regional rural banks | 43,30,190 |

| district CO-OP bank | 48,581 |

| state CO-OP banks | 4,620 |

| Urban CO-OP banks | 17,355 |

| DOP | 3,02,712 |

Atal Pension Yojana Benefits

The main benefits of Atal Pension Yojana are below:

1. Source of income after retirement

The people enrolled in Atal pension Yojana gets a steady income after reaching 60 years of age. This enables them to meet their needs like medications, food, etc.

2. Pension scheme backed by the government

The Pension is risk-free as it is backed by the Government and regulated by Pension Fund Regulatory Authority (PFRDA)

3. Supporting the employees of unorganised sectors

Usually, the employees working under unorganised sectors faced issues in meeting their needs in their later years. Atal Pension Yojana is a boon for these people.

4. Facility of nominee

There is a facility In case of death of the beneficiary, Spouse can continue getting the pension or can terminate the account. In case of death of both beneficiary and spouse, Nominee will receive the amount.

Features of Atal Pension Yojana

The main features of Atal Pension Yojana are below:

1. Automatic Debit

The account of the beneficiary is directly debited. The beneficiary should ensure to maintain the amount of their account to meet this auto-debit.

2. Contribution can be increased

The beneficiary is free to increase or decrease the monthly contribution. The corpus amount will be changed accordingly.

3. Guaranteed Pension

The beneficiary will receive the monthly pension of Rs.1000, Rs.2000, Rs.3000, Rs.4000, and Rs.5000 according to their monthly contributions.

4. Age Restrictions

Individuals can start their contribution from 18 years of age and the maximum age to decide the contribution is 40 years. Minimum 20 years of contribution is a must.

5. Withdrawal Policies

After attaining the age of 60 years, the beneficiary will receive the monthly pension. In case of death or illness, the beneficiary can exit the scheme before the age of 60 years. In case if the beneficiary is dead before 60 years of age, the spouse will be entitled to receive the amount or exit the scheme. If the beneficiary wants to withdrawal the amount before 60 years of age, only the cumulative contributions and earned interest will be refunded.

6. Penalty

If the payment gets delayed the Bank is required to collect an additional amount of money. This extra money will range from Rs. 1 to Rs. 10.

APY Chart for Penalty charges for different contributions listed

| Charges | Contributions |

| Rs.1 | up to Rs. 100 per month |

| Rs.2 | up to Rs. 101 to Rs. 500 per month |

| Rs.5 | up to Rs. 501 to Rs. 1000 per month |

| Rs.10 | beyond Rs. 1001 per month |

- If the payment of contribution is discontinued for more than 6 months than the account will be frozen.

- If the payment of contribution is discontinued for more than 12 months than the account will be deactivated.

- If the payment of contribution is discontinued for more than 24 months than the account will be closed.

7. Tax Exemptions

Under section 80CCD of the income tax Act, 1961, the monthly contribution amount is exempted from tax. An additional tax exemption of Rs, 50,000 for contribution to APY is allowed.

Monthly Contributions Under Atal Pension Yojana Chart

| Entry age | No. of years of contribution | Monthly contribution (Monthly Pension – Rs.1000, Indicative Return of Corpus- Rs.1.7 lac) | Monthly contribution (Monthly Pension – Rs.2000, Indicative Return of Corpus- Rs.3.4 lacs) | Monthly contribution (Monthly Pension – Rs.3000, Indicative Return of Corpus- Rs.5.1 lacs) | Monthly contribution (Monthly Pension – Rs.4000, Indicative Return of Corpus- Rs.6.8 lacs) | Monthly contribution (Monthly Pension – Rs.5000, Indicative Return of Corpus- Rs.8.5 lacs) |

| 18 | 40 | 42 | 84 | 126 | 167 | 210 |

| 19 | 41 | 46 | 92 | 138 | 183 | 228 |

| 20 | 40 | 50 | 100 | 150 | 198 | 248 |

| 21 | 39 | 54 | 108 | 162 | 215 | 269 |

| 22 | 38 | 59 | 117 | 177 | 234 | 292 |

| 23 | 37 | 64 | 127 | 192 | 254 | 318 |

| 24 | 36 | 70 | 139 | 208 | 277 | 346 |

| 25 | 35 | 76 | 151 | 226 | 301 | 376 |

| 26 | 34 | 82 | 164 | 246 | 327 | 409 |

| 27 | 33 | 90 | 178 | 268 | 356 | 446 |

| 28 | 32 | 97 | 194 | 292 | 388 | 485 |

| 29 | 31 | 106 | 212 | 318 | 423 | 529 |

| 30 | 30 | 116 | 231 | 347 | 462 | 577 |

| 31 | 29 | 126 | 252 | 379 | 504 | 630 |

| 32 | 28 | 138 | 276 | 414 | 551 | 689 |

| 33 | 27 | 151 | 302 | 453 | 602 | 752 |

| 34 | 26 | 165 | 330 | 495 | 659 | 824 |

| 35 | 25 | 181 | 362 | 543 | 722 | 902 |

| 36 | 24 | 198 | 396 | 594 | 792 | 990 |

| 37 | 23 | 218 | 436 | 654 | 870 | 1087 |

| 38 | 22 | 240 | 480 | 720 | 957 | 1196 |

| 39 | 21 | 264 | 528 | 792 | 1054 | 1318 |

How to Apply for Atal Pension Yojana (APY)?

Interested peoples can apply for Atal Pension scheme in any bank if he/she meets the eligibility criteria. Follow the following steps to apply for the Atal pension scheme:

- Visit the bank where you have an account.

- Ask for the APY subscribe form and fill it properly.

- Submit the filled application form with 2 passport size photos and Aadhar card Xerox.

- An active phone number is required.

The same steps can be followed for downloading the application form for Atal Pension Yojana online.

Terms and Conditions for Atal Pension Scheme

- All the saving bank account holders are eligible for the Atal Pension Yojana.

- The central government will also contribute 50% of the total contribution amount or Rs.1000 per year (the lower one will be given preference) for each subscriber for 5 years.

- The monthly contribution will be deducted from the subscriber’s account on an auto-debit basis.

Frequently Asked Questions

Q1. Who are the people not eligible for Government’s contribution under APY?

Ans. The Subscribers who are already covered under Statutory social schemes will not receive the government’s contribution. The schemes are as follow:

- Employees provident fund & Miscellaneous provision Act, 1952

- The coal mines provident fund & Miscellaneous provision Act, 1948

- Assam tea plantation & Miscellaneous provision Act, 1955

- Seamen’s Provident fund Act, 1966

- Jammu Kashmir employees provident fund & Miscellaneous provision Act, 1961

- Another statutory social security scheme

Q2. Is an Aadhaar card necessary for opening an APY account?

Ans. No, for opening the APY account aadhaar card is not necessary but it is an important document for enrollment.

Q3. Is it important that I must have a savings account for joining the APY?

Ans. No.

Q4. What is the payment mode of the contribution?

Ans. Monthly contributions will be deducted from your savings account automatically.

Q5. Can I join APY without mentioning any nominee?

Ans. Details of the nominee are an important part of the APY form.

Q6. How can I check the contribution status of my APY account?

Ans. You can check the status of the contribution using your registered number. You will get the regular notification on the registered mobile number via SMS.