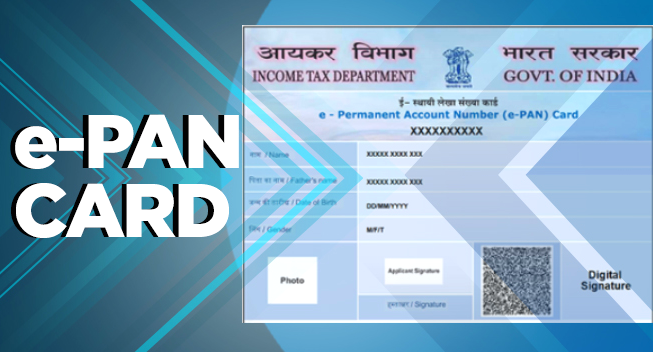

e-PAN card is digitally signed PAN Card issued by the income tax department in electronic or digital format. e-PAN card is a valid proof of PAN card which contain a QR code possessing demographic details of PAN card owner. It contains details like the Name of the cardholder, Date of birth, and photograph and these are accessible through a QR code reader and are duly recognized. Those PAN Cardholder who has a valid Aadhaar number and a registered mobile number with an Aadhaar card can avail the facility of the e-PAN card. The process of e-PAN card allotment is paperless and issue free of cost.

Permanent Account Number or PAN is a 10 digit alphanumeric number that is issued by the income tax department and is valid for a lifetime. Now, it can be obtained in digital format also as e-PAN. A person who has a business or any profession with a total turnover of more than 5 lacs in any previous year has to get the PAN card issued by the income tax department. Also, If a person wishes to carry out a specific financial transaction that needs a Quotation of PAN, must obtain a PAN Card.

e-PAN Card Details

e-PAN card is relevant to the physical PAN card which allows taxpayers to carry out their transactions easily and it also helps the income tax department to track such transactions. The e-PAN service is only available to those applicants whose new PAN card request is submitted via NSDL, UTITSL, or the income tax department’s e-filling website. Only Indian citizens can apply for e-PAN card.

e-PAN card contains details like Photograph, signature, PAN Number, Father’s Name, and Date of birth and the QR code contains the biometric information of the Pan cardholder. After completing the download process of e-PAN card, the owner can get their e-PAN on their registered Email ID.

Eligibility for e-PAN Card

The Applicant must fulfill the below-mentioned eligibility criteria to apply for an e-PAN card:

- The applicant must be an Indian Resident.

- Applicant must possess an updated Aadhaar.

- Applicant must have a valid mobile number that is linked with Aadhaar.

- The applicant must be an individual taxpayer.

How to Apply for e-PAN Card?

To apply for an e-PAN card, A valid and updated Aadhar is a must. You will receive an OTP on the registered mobile number to perform the e-KYC. No other document is required. e-PAN is issued using Aadhaar details. You can apply for e-PAN through the following means:

- Through UTIITSL

- Through the Income tax department

Let’s have a look at the procedure of both in detail.

Apply for e-PAN Card through UTIITSL

Follow the following steps carefully to successfully apply for an e-PAN card through UTIITSL.

- Visit the official website of UTIITSL.

- Click – PAN Card Services.

- There will be 3 options available- Both Physical PAN cards and e-PAN, e-PAN Only, and No Physical PAN Card. You must select e-PAN only.

- Fill in the personal details required along with valid and Aadhaar verified Mobile number and Email ID.

- Submit the Aadhaar proof, check the acknowledgment box, and click on Submit option.

- Now, Sign on a blank paper to verify the signature which is called the e-sign method.

- The signature resolution must be 200 DPI and the file type must be JPEG- Size: 10 KB and dimensions: 2 cm x 4.5 cm.

- Once you submit it, a scanned copy of your signature and 15 digit acknowledgment number will be delivered to your mobile number or email ID.

- Read the Captcha code and enter it in the box.

- Click Submit to complete the process. You will receive an SMS for the successful application of e-PAN.

Apply for e-PAN Card through Portal

Steps how to apply for e-PAN card through incometaxindiaefiling portal:

- Visit the Official website of incometaxindiaefiling and click on Apply Instant e-PAN.

- Read the guidelines and click on Next.

- Enter the personal details as on Aadhar Card.

- After submitting the details, Sign on blank paper to verify.

- Scan and upload the sign and passport size photograph.

- After the verification, your e-PAN card submission will be initiated.

- Click on Submit to complete the process. After this, You will receive an SMS for the successful application of e-PAN.

How to Download e-PAN card

Downloading an e-PAN card is a very simple method that doesn’t require any documentation. Applicants use digital methods to download e-PAN cards. Let’s have a look at how to Download e-PAN through NSDl or UTITSL.

e-PAN Card Download by PAN number

You can download your e-PAN card by using PAN card number on UTIITSL or NSDL by following the steps mentioned below:

- Visit the official website of UTIITSL or the NSDL portal.

- Click on Download e-PAN card (on NSDL portal).

- For the UTIITSL portal, click on APN Services and then click on Download e-PAN.

- Now, Enter your PAN number carefully, Aadhaar number, Date of birth, and GSTN.

- Read the Captcha code and enter it in the box.

- Check the details you have provided and click on submit.

- You will receive an OTP on the registered mobile number.

- Enter your OTP can click to validate.

- Now, click on Download PDF after the validation process.

- The PDF format of the e-PAN card is secured with a Password. Password will be your Date of birth.

Frequently Asked Questions

Q1. Can I also get a Physical PAN card after issuing the e-PAN card?

Ans. No, if you have an e-PAN card, no physical PAN will be issued. You can use e-PAN from the income tax department website.

Q2. Is e-PAN the same as Physical PAN?

Ans. Yes, e-PAN is the same as physical PAN in all manner with a QR code containing your biometric information taken through the Aadhaar database. It can be used the same as Physical PAN.