The banking system has evolved over the years and banks can now be identified through unique codes. To curb potential frauds, these codes also play a vital role. IFSC and MICR are some of the most relevant codes in this reference.

Definition of IFSC Code and MICR Code

The definition of IFSC code and MICR code are:

| IFSC Code | MICR Code |

| IFSC or Indian Financial System Code is ideally an 11 digit alphanumeric code which has been assigned by Reserve Bank of India (RBI) to every bank branch which is a participant in the payment system. | MICR code is also known as Magnetic Ink Character Recognition. It is found in all bank cheques on the white line on the bottom edge. This line is known as MICR band. This code is used for enhancing security in any and every kind of transaction. |

| IFSC code is also used by electronic payment system applications like NEFT and RTGS. This code is mandatory for any kind of fund transfer from any of the bank account to others. | The details of cheque can be found on the MICR Code.The first three digits of MICR code denote the city; the remaining three denote the bank while the last three indicate the bank branch.MICR code has been introduced by Reserve Bank of India to make the banking system transparent and efficient. |

Importance of IFSC

IFSC helps in finding the entity of the bank. In other words, IFSC can be considered as the birthmark of the bank.

- This code also helps RBI identify the place from where the funds have been transferred and the location where these funds will eventually end up.

In a nutshell, the IFSC is basically used for the electronic transfer of money. IFSC also helps in eliminating any kind of discrepancy in the fund transfer process.

Importance of MICR Code

MICR code, on the other hand, is used to help process bank cheques easily and quickly.

- Each bank has been provided with a unique MICR Code which makes the banking process less cumbersome.

Use of IFSC Code

- Financial transactions can be done smoothly with the help of IFSC. These transactions can be done worldwide and one does not need to walk to the bank branch.

- Transferring funds is a matter of minutes when IFSC is used. The user can transfer money in a matter of minutes without the need of visiting a bank or standing in long queues.

- As access to the banking system can be done seamlessly through use of IFSC, this also curbs the potential misuse of the banking system.

Use of MICR Code

As is evident, MICR or Magnetic ink character recognition is ideally the information that is available on the bottom of a cheque.

- Through the use of MICR, computers can internalize the routing numbers, account numbers and other related information from documents like cheques.

- These MICR numbers are usually printed with magnetic ink or toner. These MICR codes are usually in major MICR fonts. Computers can read the characters written in these MICR codes.

MICR code thus allows the appropriate cheques to be cashed so that no financial misappropriation takes place in any financial transaction.

How to get IFSC Code?

Any user can search for IFSC by visiting the official website of the concerned bank or by calling the helpdesk of the bank.

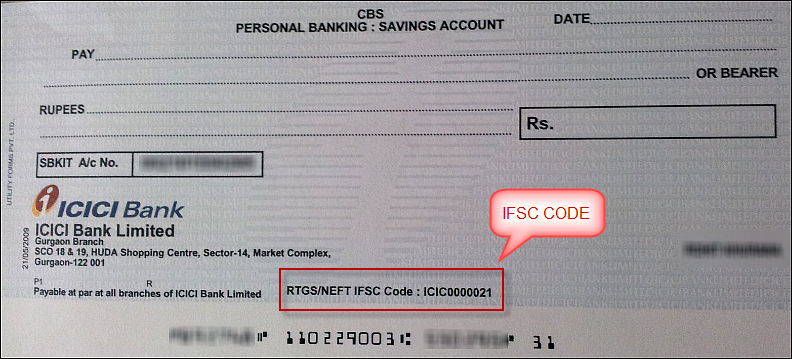

- The IFSC can also be found on cheque book or the passbook of the account holder. The IFSC can also be found on the Reserve Bank of India’s official website too.

The information related to IFSC can also be found on third-party websites like policybazzar.com.

How to get MICR Code?

As hinted above, the MICR code on a cheque is required for all electronic transactions that are done through cheques.

- Finding the MICR code in cheque of any bank branch is a relatively easy process. Ideally, these can be found by visiting the bank branch physically or can be searched on the website of the concerned bank.

- MICR code can also be found by visiting third-party websites like bankmicrcode.com.

- For finding the MICR code through this method, the users will have to select the appropriate bank by scrolling down on the options in the menu.

The state in which the branch is located has also to be listed out. Thereafter, the district and city also have to be listed by scrolling down from the menu. Once the branch location is keyed in, the website will display the required MICR Code.

The use of IFSC and MICR codes is the best and the safest way of conducting any banking transaction process. The use of these codes not only ensures the safe transaction of the users’ money but also ensures that the entire process is done in a safe and secure manner.